free crypto tax calculator uk

There are cloud-hosting tools specifically designed for crypto miners. 12570 Personal Income Tax Allowance.

Top 10 Latest Cryptocurrency News From Coinpedia Cryptocurrency News Cryptocurrency Blockchain

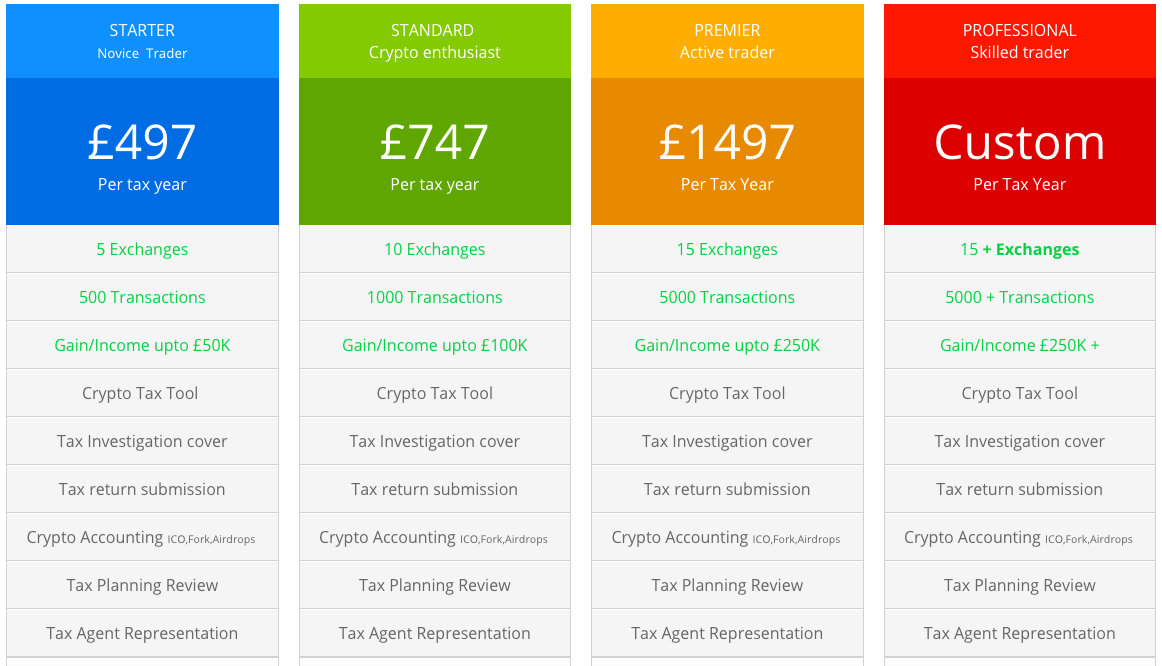

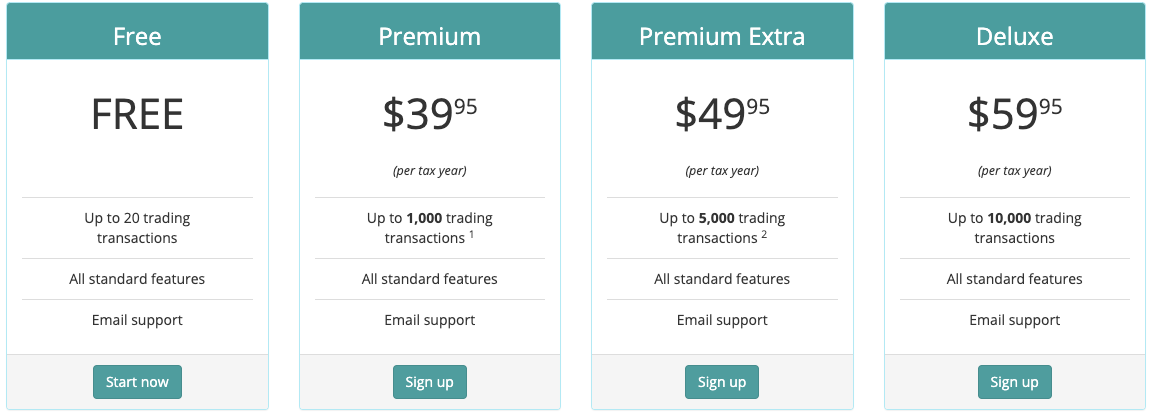

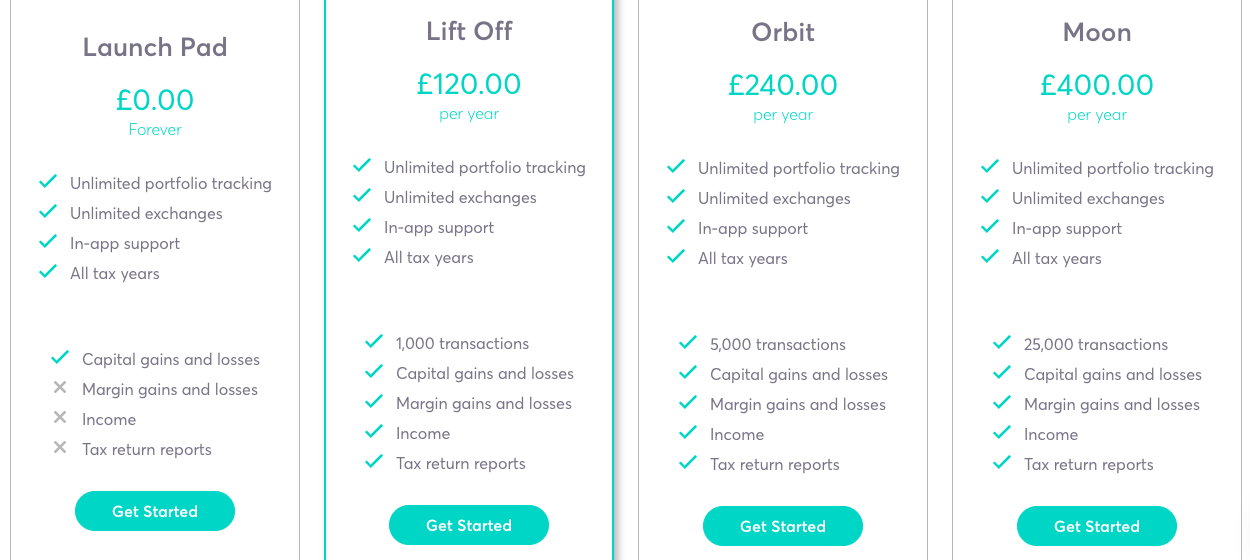

Crypto Tax Calculators annual subscription ranges from 49 to 399 and supports up to 100000 transactions.

. The tax rate on this particular bracket is 325. If youre looking to get started with a UK crypto tax calculator right away one of the following options is likely your best bet. In the UK you only pay Capital Gains Tax if your overall gains for the tax year after deducting losses are above the Annual Exempt Amount AEA.

Divide the initial investment amount. Ad Crypto commissions are only 012-018 with no hidden spreads or markups. This means you can get your books.

The tax rate on this particular bracket is 325. The alternative is hiding it and if it is found out by the IRS then you would be taxed and fined multiples of that amount instead of just the tax itself. Capital gains tax report.

Take the initial investment amount lets assume it is 1000. Ad Short sell BTC for great profit kucoin Exchange by your side. It helps you calculate your capital gains using Share Pooling in accordance with.

Heres an example of how to calculate the cost basis of your cryptocurrency. The Annual Exempt Amounts are pictured. CoinTrackinginfo - the most popular crypto tax calculator.

Then youll need to specify the buy and sell date. Ad Bitget is The Best Place to Buy Crypto Without Verification or ID Anonymously. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC.

CryptoTaxCalculator is a software solution designed to automate your crypto tax nightmare saving the pain of manually. Check out our free. How to calculate crypto taxes in the UK.

Trade crypto plus stocks options futures bonds funds and more on one platform. It makes calculating your capital gains easy by using Share Pooling and follows HMRCs guidelines. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

It has been implemented. It offers a free trial that allows you to import data review. Coinpanda generates ready-to-file forms based on your trading.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while. Trade crypto plus stocks options futures bonds funds and more on one platform. Your first 12570 of income.

Here are our Top Picks for Crypto Tax Calculators. Capital Gains Tax Allowance on Crypto. Best Crypto tax reporting and calculation software.

In both the 202122 and 202223 tax years UK residents are given an annual capital gains tax allowance of 12300. You simply import all your transaction history and export your report. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc.

Over one million people trust Bitget to buy sell cryptocurrencies. File your crypto taxes in the UK. Enter the price for which you.

Ad Crypto commissions are only 012-018 with no hidden spreads or markups. 3 Cointelli Cointelli is the next-generation cloud-based crypto tax preparation software developed by Mark Kang the CEOco-founder and a CPA. The Capital Gains tax.

To use this crypto tax calculator input your taxable income for 2021 before considering any crypto gains and your 2021 tax filing status. Free vs paid crypto tax. Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK.

UK crypto investors can pay less tax on crypto by making the most of tax breaks. There is no exemption. Seize the perfect opportunity of BTC bottom fishingDont miss the perfect time.

Blox supports the majority of the crypto coins and guides you through your taxation process. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the.

Crypto tax breaks. TokenTax is one of the most extensive tax calculation and reporting software out there for any crypto trader. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

Straightforward UI which you get your crypto taxes done in seconds at no. How to calculate your UK crypto tax. This allowance includes crypto gains but also stock and property gains.

Koinly is the most popular software to calculate crypto taxes. However recall that there is a broad Capital Gains Tax allowance. Youll need to separate all your transactions into capital gains transactions and income transactions.

Dont have an account. Koinly helps UK citizens calculate their crypto capital gains. UK citizens have to report their capital gains from cryptocurrencies.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

The Uk Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Bitcoin Tax Calculator In The Uk 2021

Bitcoin Price Prediction Today Usd Authentic For 2025

How To Calculate Your Uk Crypto Tax

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Calculate Your Crypto Taxes With Ease Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare